Email Impersonation Fraud

Email Impersonation Fraud: A Growing Tactic

Employees and customers alike beware! Email impersonation is on the rise – and hackers are constantly finding new ways to trick their targets, like in the scenario below.

The Scenario

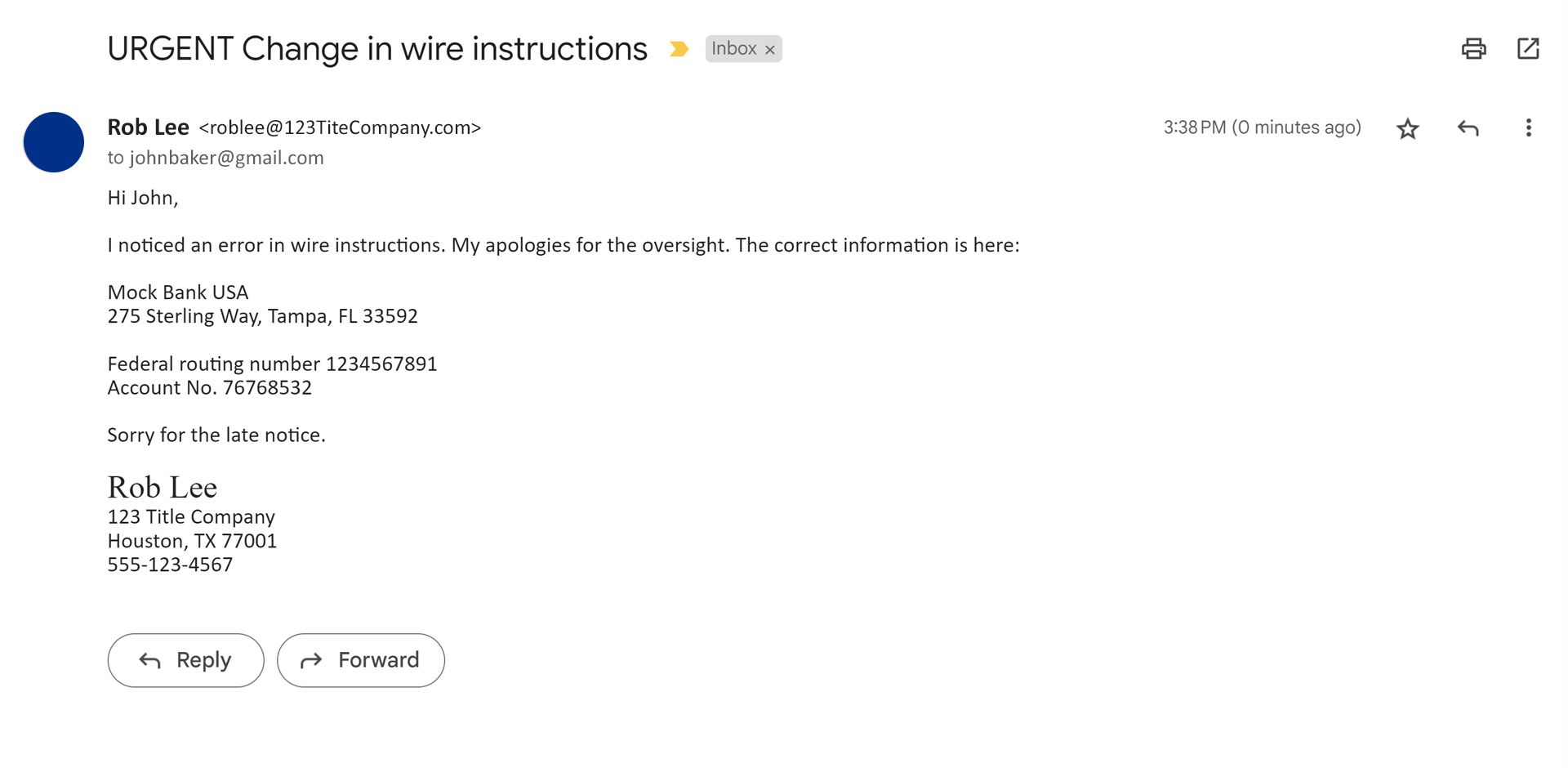

John Baker was nearing the close on the sale of his home. He had one more task to complete before his signing appointment the next day – initiate a wire transfer for his closing costs. He was in line at the bank when he received an unexpected email from his title agent, Rob Lee:

Although a bit frustrated by the mistake, John felt fortunate that he saw the email before he reached the teller’s window and was able to update the bank account before wiring his closing funds.

The next morning, John walked into 123 Title Company where Rob Lee worked, excited for his signing appointment. As soon as Rob walked into the lobby to greet John, he said, “We haven’t received your wire. Did you send it?” John was baffled and replied, “I don’t know why not. I sent it yesterday with the updated information you sent me.” Rob’s facial expression immediately turned from confusion to fear. “I didn’t send you an email yesterday,” he stated. John replied “Yes, you did,” as he reached for his phone. He pulled up the email and handed the phone over to Rob. Rob looked up and said, “This isn’t good. I didn’t send this email.”

After discussing the incident, it was apparent that John and Rob were victims of a business email compromise (BEC) impersonation attack – a type of phishing attack where a malicious actor creates an email address that looks like it came from a legitimate business and impersonates an employee to fool consumers into diverting funds into a bank account owned by the fraudster. In this situation, the urgent request for change in wire instructions came from the email address roblee@123TiteCompany.com, but Rob Lee’s email address is roblee@123TitleCompany.com. The fraudster’s email was missing the “l” in “Title.” The phone number in the message also didn’t belong to Rob. Luckily, Rob promptly followed company wire fraud procedures and was able to recover John’s funds.

A Growing Tactic

While the names and details in the scenario above are for illustrative purposes, they are based on real events. Unfortunately, this scenario is only one of several types of email impersonation tactics seen in the real estate and title industries. Fraudsters aren’t just impersonating title professionals, but all parties to a real estate transaction, even the buyer and seller.

How to Outsmart the Fraudsters

Always be wary of unexpected communications that urge you to take immediate action – even if they appear to come from someone you know. Cybercriminals are super sneaky, so it’s up to us to stay one step ahead by following these best practices:

• Educate yourself on emerging schemes. Click here to learn more from the Federal Bureau of Investigation (FBI) about common scams and crimes, and how to prevent them.

• Practice good cyber hygiene. To help mitigate cybersecurity risks, implement good cyber hygiene habits like using strong and complex passwords, protect email accounts with multi-factor authentication (MFA) and using a virtual private network (VPN) when connecting to the public wi-fi. For more cyber hygiene tips, click here.

• Learn to recognize red flags. While phishing schemes are constantly evolving, most attempts include urgent requests and unexpected emails. Last-minute changes in wire instructions, like the one that John received in the story, are another telltale sign of fraud.

• Stay vigilant. Cybercriminals know we’re all multitasking, and they’re hoping we’re too busy to stop and question requests that appear to come from someone we know. Don’t fall for it!

• Never use contact information in an unexpected communication – even if you recognize the sender or have done business with them in the past. You can never really be sure who is on the other end of that communication, so it’s best to disengage and go straight to the source.

• Always call a TRUSTED phone number to verify the request BEFORE acting on it. If John would have called Rob using a trusted phone number to verify the change in wire instructions, he would have avoided exposing himself to fraud and potential loss.

Pro Tip: Customers should reference the list of phone numbers provided by their title professional when they open escrow.

Don’t worry about looking silly or offending anyone by double checking unexpected requests; true professionals will understand and appreciate the effort you put into verifying the request. If the company is unaware that someone is impersonating a current or former employee, reporting it gives them the opportunity to warn others and take steps to mitigate the fraud. (Which kind of makes you a hero, too!)

To learn more about common cybersecurity threats to your business, click here. Real estate customers can also check out these tips for preventing wire fraud, which often starts with business email compromise and email impersonation.

Prior Articles

Top Five CRE Markets to Watch in 2026

Top Five CRE Markets to Watch in 2026January 21, 20262026 is projected to be a landmark year for commercial real estate (CRE). Investors aren’… Read More »

Date Center Real Estate: Important Decisions

Data Center Real Estate: Important ConsiderationsOctober 30, 2025While industrial warehouses have expanded rapidly to meet the demands of the… Read More »

Considering Refinancing Your Home

Considering Refinancing Your Home Loan?Have you purchased property since 2022, when mortgage interest rates jumped from the 3% range to almost 8%? If… Read More »

Why Title Insurance Matters

Why Title Insurance Matters: A Cautionary TaleCan you imagine losing your home because someone else has a legal claim to it? It’… Read More »

13 DIY Staging Tips for Home Sellers

13 DIY Staging Tips for Home SellersIf you’re considering selling your home, you may want to think about staging it. According to the National… Read More »

Commercial Snapshot Q1 2025

Commercial Market Snapshot Q1 2025 March 5, 2025MARKET OVERVIEWThe fourth quarter of 2024 marked a return to positive and broad Commercial Real… Read More »

How Hybrid Work is Changing the Office Sector

How Hybrid Work is Changing the Office SectorBy 2025, hybrid work is projected to be the dominant work model for many companies across the nation.… Read More »

Commercial Snapshot Q4 2024

Commercial Market Snapshot Q4 2024December 4, 2024MARKET OVERVIEW The third quarter’s performance was better than expected and market sentiment… Read More »

10 Easy Tips to Create a Healthier Home

10 Easy Tips to Create a Healthier HomeCreating a healthier home is a vital step to enhancing your overall well-being. Your living environment can… Read More »

7 Reasons Homeowners Need Title Insurance

7 Reasons Homeowners Need Title InsurancePurchasing a house is a momentous occasion and likely one of the biggest purchases you’ll ever make.… Read More »