Economic Update Q4 2022

The General Economy

The economy in the fourth quarter showed signs of the battle against inflation. Steep mortgage rates hobbled the residential construction and home improvement industries, which weighed down overall growth. Despite smoother supply chains, businesses were hurt by costlier financing options. Painful interest rates were on the minds of consumers as well, who also felt less wealthy as the stock market wobbled and home values declined.

But inflation finally eased meaningfully, helped by lower energy and car prices. The Consumer Price Index (CPI)’s annualized rate for the quarter was projected to have been 7.4 percent, down almost a full percentage point from the previous quarter. Unemployment, despite headline-grabbing layoffs, ended at 3.5 percent, better than it began the year. Consumer sentiment and spending reacted positively, shaking off prognostications of a recession. Holiday travel was on par with 2019 levels and eating out remained the bright spot of retail sales, growing over 14 percent since last year. Better-stocked inventories, Black Friday deals that spanned a month, and increased reliance on credit cards1 supported a 3.6 percent rise in Personal Consumption Expenditures – the best showing for the year. With consumers as a counterweight to faltering sectors, annualized Gross Domestic Product (GDP) growth was forecast to be below the long-term average, but still positive at 1.1 percent.

The Real Estate Sector

Residential

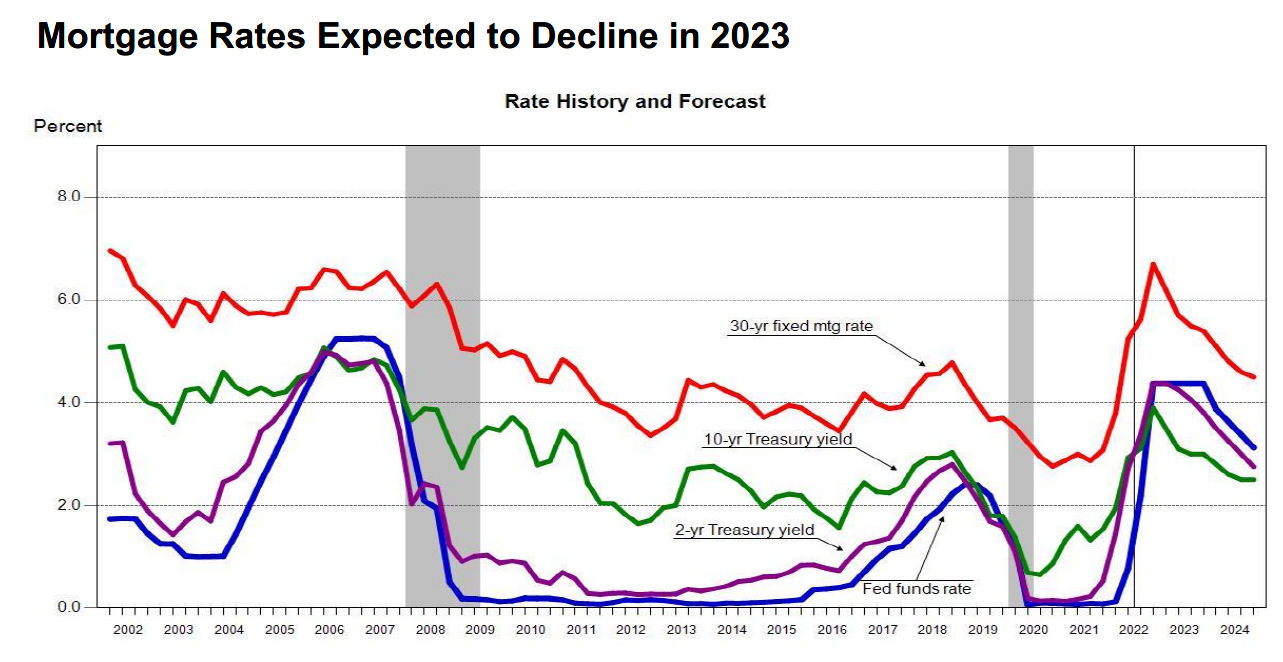

With the Federal Reserve (The Fed) boosting its rates to combat inflation2 by another 1.25 percent during the quarter, its restrictive efforts were apparent in the extended housing market downturn. The 30-year fixed mortgage rate reached a multi-decade high of over 7 percent in late October and early November, before settling into the mid-6 percent range by quarter end. Consequently, the drop in single-family home sales persisted, albeit at a less severe rate than in the third quarter. Talk of next year’s recession and the prospect of being saddled with homes that reached completion but are not selling due to rising interest rates further dampened builder confidence, single-family starts and permits. The softening market was also evident in the continued slide in the median price of existing homes and subdued growth in new home prices.

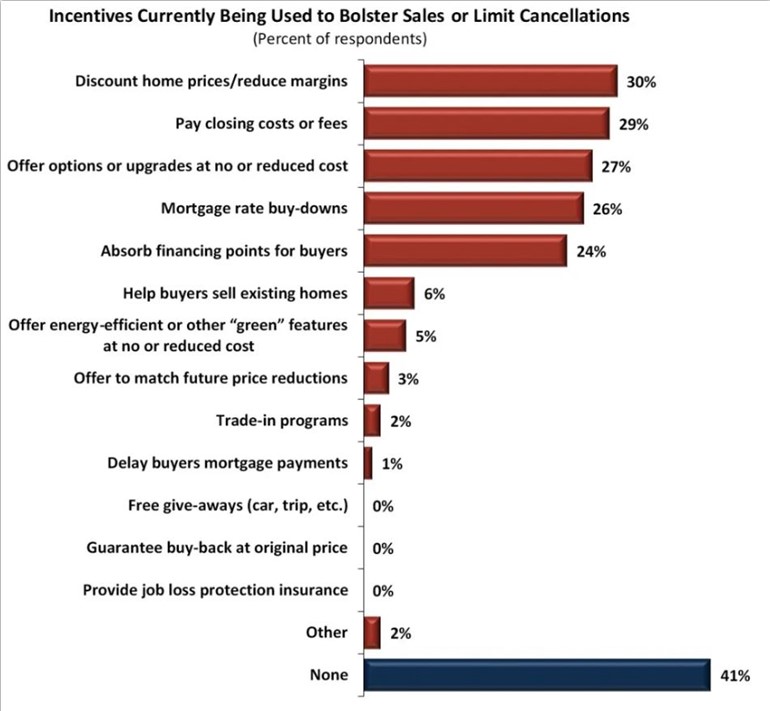

Despite these lackluster numbers, there was not much talk of a bubble bursting as with past downturns. Demand has been driven by millennials reaching their prime homebuying years, not by speculation. Furthermore, builders were able to boost purchases through non-price concessions. Both builders and buyers found ways to take the bite out of interest rates through mortgage rate buy-downs and paying points up front.

Source: Survey for the NAHB/Wells Fargo Housing Market Index, November 2022

Commercial

Commercial Real Estate (CRE) experienced further contraction due to rising interest rates and uncertainty. A significant fall in office deals drove down the average. The office sector was plagued with persistent haziness in the new normal for business space. Even hot sectors were impacted; industrial properties lost sizzle as ecommerce demand normalized, venture capital funds became more tightfisted with life science companies and the crypto implosion shook the data center market.

While not immune to general economic forces, the retail sector was resilient and saw rising rental asking rates3. Businesses that survived the pandemic did so through adaptation. Landlords changed their store mix to include more medical and wellness providers, restaurants and pop-up retailers. With their location close to residential areas, some companies leveraged their storefronts as quasi-industrial space, using it as the “last mile” for online sales.

Particularly effective was the integration of in-store and online shopping. Within this, perhaps the biggest adaptation was the embrace of Buy Online, Pickup In-Store (BOPIS) by even the smallest of establishments. BOPIS has been growing steadily in popularity since 2019 and saw a solid 4.1 percentage-point gain from last year’s holiday season, according to JLL. Focusing on customer service helped retailers as well. Neighborhood centers that offered more in-person services were an area of growth; net absorption3 rose by 35 percentage points in the third quarter from the previous quarter. Home improvement stores, reeling from the drop in residential renovation spending, highlighted their knowledge and targeted professionals.

Source: JLL Research, Holiday Survey 2022

A Glance Forward

Forecasts show that the first quarter of this year will be the beginning of a recession (with GDP falling and unemployment rising). Whether moderate and prolonged, or short and shallow, it all hinges on consumer spending. Many people have drawn down their savings4 and will be handling high interest on their holiday credit card purchases while facing more unemployment. However, businesses won’t see much immediate relief from wage pressures as the job market loosens, even as demand falters. The explosion of COVID cases in China could subdue purchases and again impact supplies. In CRE, there was a surge in redemption requests in December for non-traded private Real Estate Investment Trusts (REITs), driven mostly by concerns over increasingly challenged credit conditions. A few large players limited withdrawals. Now market participants are watching closely for contagion to other CRE investment vehicles. With many areas of the economy sputtering, GDP could fall by 1.5 percent in the first quarter.

Although the residential housing market’s negative momentum will carry into the first quarter of 2023, some forecasters believe that this may be the bottom. Single-family existing and new home sales are forecast to decline only slightly (-1.5 and -3.3 percent, respectively) compared to drop offs seen last year. Housing prices – even for new homes – should move in the right direction to support a rebound. The Mortgage Bankers Association (MBA) foresees a small bounce back in single-family home starts. Encouragingly, in December, the National Association of Home Builders registered an improved expectation for future sales for the first time since April. More builders reverted to the trend of offering smaller houses. This is good news for downsizers and millennial first-time homebuyers waiting on the sidelines for prices and rates to come down.

With inflation anticipated to bump down 1.7 percent from the last quarter, continued moderate rate hikes are expected by The Fed. The MBA forecasts that 30-year fixed mortgage rates peaked in late 2022 and will decline through 2024.

Source: Federal Reserve Board, Freddie Mac, MBA Forecast, 2022

So, while the first months of 2023 certainly will have bad news as we move through consumer, labor and real estate market corrections, there may be more normalcy evolving as well.

1 Board of Governors of the Federal Reserve System (US), Consumer Loans: Credit Cards and Other Revolving Plans, All Commercial Banks [CCLACBW027SBOG], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CCLACBW027SBOG, January 3, 2023.

2 Board of Governors of the Federal Reserve System (US), Federal Funds Target Range - Upper Limit [DFEDTARU], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFEDTARU, January 4, 2023.

3 Copyright ©2022 “October 2022 Commercial Market Insights.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. January 2023, October 2022 Commercial Market Insights (nar.realtor)

4 U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT, January 4, 2023.

Prior Articles

Top Five CRE Markets to Watch in 2026

Top Five CRE Markets to Watch in 2026January 21, 20262026 is projected to be a landmark year for commercial real estate (CRE). Investors aren’… Read More »

Date Center Real Estate: Important Decisions

Data Center Real Estate: Important ConsiderationsOctober 30, 2025While industrial warehouses have expanded rapidly to meet the demands of the… Read More »

Considering Refinancing Your Home

Considering Refinancing Your Home Loan?Have you purchased property since 2022, when mortgage interest rates jumped from the 3% range to almost 8%? If… Read More »

Why Title Insurance Matters

Why Title Insurance Matters: A Cautionary TaleCan you imagine losing your home because someone else has a legal claim to it? It’… Read More »

13 DIY Staging Tips for Home Sellers

13 DIY Staging Tips for Home SellersIf you’re considering selling your home, you may want to think about staging it. According to the National… Read More »

Commercial Snapshot Q1 2025

Commercial Market Snapshot Q1 2025 March 5, 2025MARKET OVERVIEWThe fourth quarter of 2024 marked a return to positive and broad Commercial Real… Read More »

How Hybrid Work is Changing the Office Sector

How Hybrid Work is Changing the Office SectorBy 2025, hybrid work is projected to be the dominant work model for many companies across the nation.… Read More »

Commercial Snapshot Q4 2024

Commercial Market Snapshot Q4 2024December 4, 2024MARKET OVERVIEW The third quarter’s performance was better than expected and market sentiment… Read More »

10 Easy Tips to Create a Healthier Home

10 Easy Tips to Create a Healthier HomeCreating a healthier home is a vital step to enhancing your overall well-being. Your living environment can… Read More »

7 Reasons Homeowners Need Title Insurance

7 Reasons Homeowners Need Title InsurancePurchasing a house is a momentous occasion and likely one of the biggest purchases you’ll ever make.… Read More »